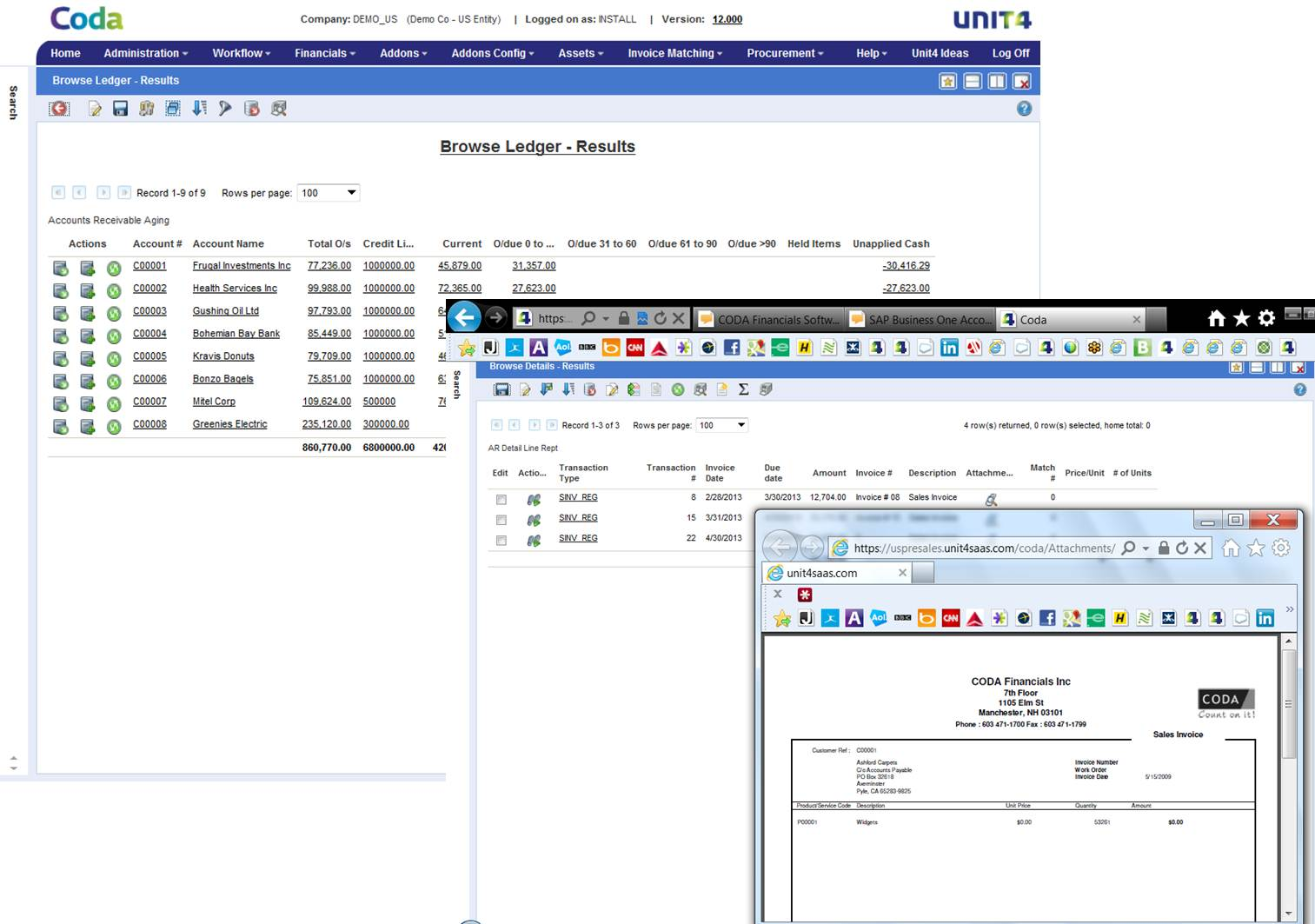

#Coda software accounting software

Accounting software provides many benefits such as speed up the information retrieval process, bring efficiency in Bank reconciliation process, automatically prepare Value Added TAX (VAT) / Goods and Services TAX (GST), and, perhaps most importantly, provide the opportunity to see the real-time state of the company’s financial position. Other organizations sell to, consult with, and support clients directly, eliminating the reseller. Clients can normally count on paying roughly 50-200% of the price of the software in implementation and consulting fees.

#Coda software accounting license

Those organizations generally pass on a license fee to the software vendor and then charge the client for installation, customization, and support services. Most mid-market and larger applications are sold exclusively through resellers, developers, and consultants. the installation and configuration of the system at the client) can be a bigger consideration than the actual software chosen when it comes down to the total cost of ownership for the business. Note that vendors may use differing names for these modules.

Reports-where the company prints out data.Payroll-where the company tracks salary, wages, and related taxes.Inquiries-where the company looks up information on screen without any edits or additions.Expense-where employee business-related expenses are entered.Debt collection-where the company tracks attempts to collect overdue bills (sometimes part of accounts receivable).Financial close management - where accounting teams verify and adjust account balances at the end of a designated time period.Bookkeeping-where the company records collection and payment.Sales order-where the company records customer orders for the supply of inventory.Purchase order-where the company orders inventory.Stock/inventory-where the company keeps control of its inventory.Billing-where the company produces invoices to clients/customers.Accounts payable-where the company enters its bills and pays money it owes.Accounts receivable-where the company enters money received.If you want to receive the CODA files through Isabel 6, first activate the ‘Export of account information’ module.Accounting software is typically composed of various modules, with different sections dealing with particular areas of accounting. And to make things even easier, you can ask to receive them through your Isabel 6 contract.ģ. Request electronic statements from your bank(s) for all your accounts. He is in the best position to inform you of the integration possibilities.Ģ. Contact the supplier of your accounting or ERP system. This simple method means increased efficiency.ġ. If you check your CODA files in your accounts every day, you have an overview of your financial position and your unpaid invoices at all times. CODA files contain sufficient information for the correct and mostly automatic booking of your financial transactions by your accounting system. This gives you extra time to follow up your unpaid invoices for example.Īs CODA files are automatically integrated in your accounts, the error margin is drastically reduced.

Integrate every account transaction electronically, directly and error-free in your accounting or ERP system. Much simpler than manually retyping paper bank statements. This uniformity also means they can be simply and quickly uploaded in your accounting software.

It means these digital versions of your account statements all have the same structure. But what exactly is CODA and how does it benefit your company?ĬODA-files are enCOded DAily statements of your Belgian corporate accounts, drawn up in accordance with the Febelfin bank standards.

#Coda software accounting free

And you free up extra time to focus on your core business. CODA files are a dream for every entrepreneur who wants to streamline the accounts.

0 kommentar(er)

0 kommentar(er)